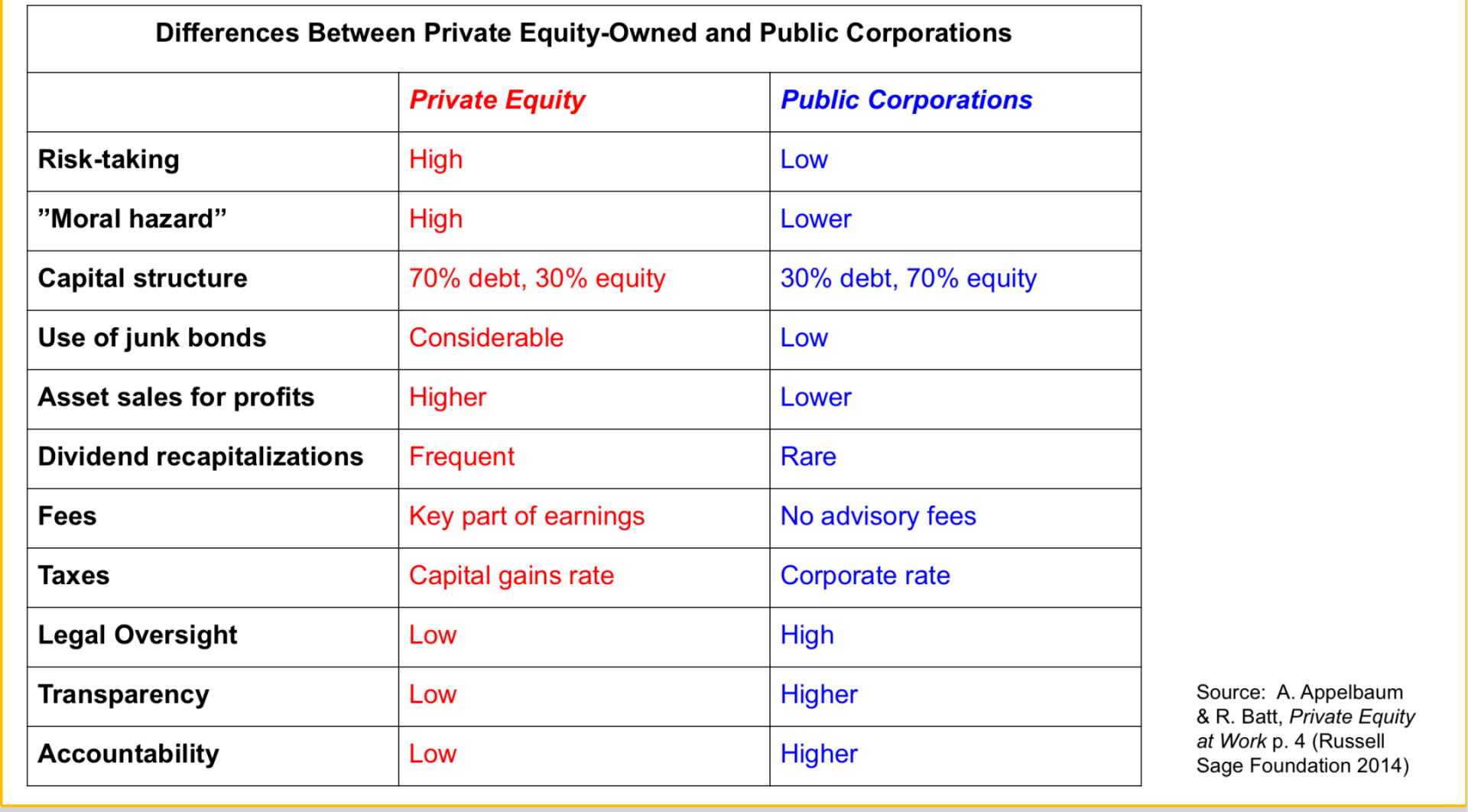

Private equity firms market themselves as financial wizards that provide above-market returns to institutional investors such as the Oregon Treasury. Initially, the returns were excellent but that changed as more investors got into the private investment market.

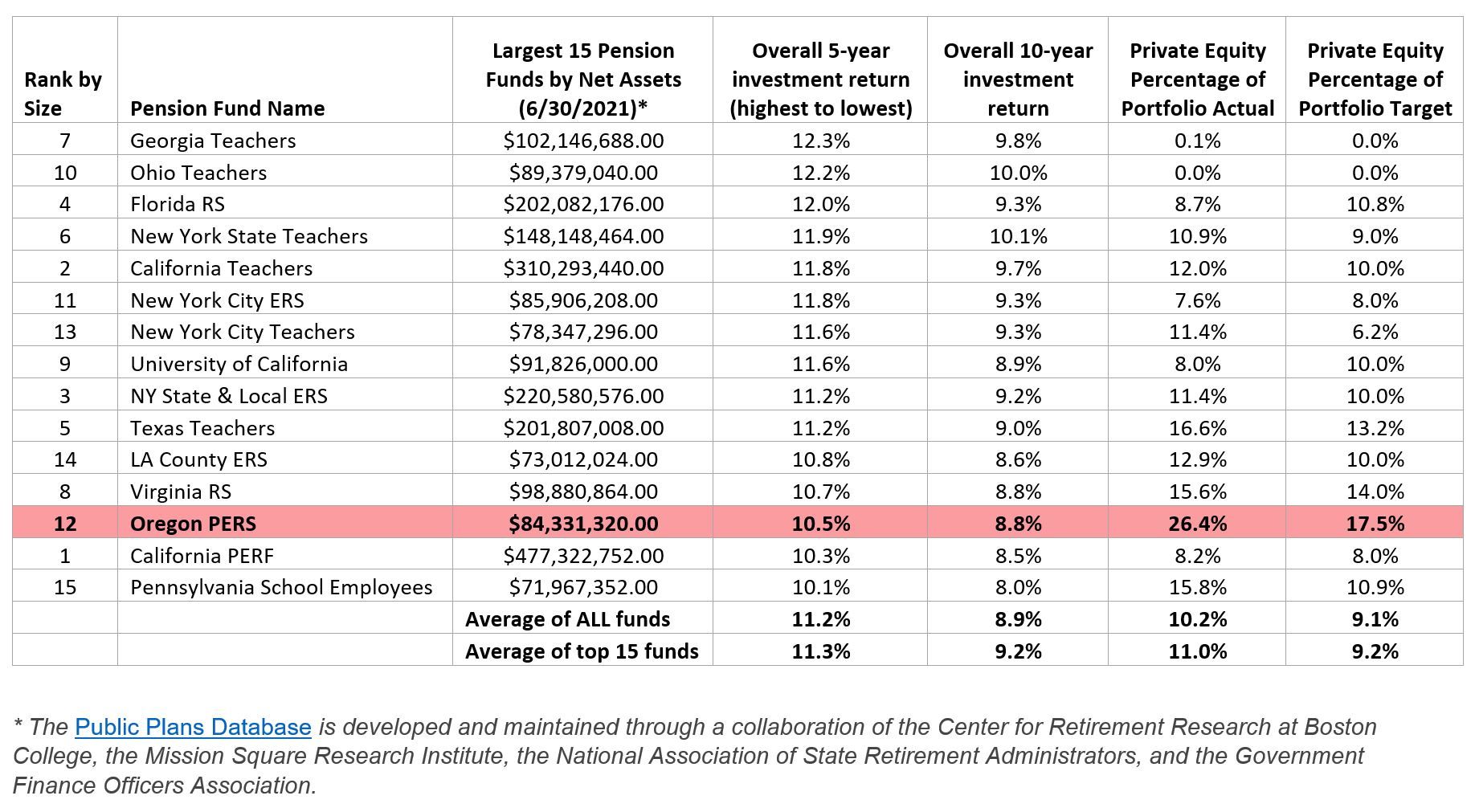

Many other state retirement funds show better average 10-year returns than Oregon’s with little or no private equity investments.

Note: The chart with June 2022 data compares just the investments labeled "private equity" at the Oregon Treasury and not the private investments labeled differently ("real estate", "opportunity", "alternatives", etc.).