Private Investments in Oregon PERS in the News

“How the Managers of Oregon’s $100 Billion Pension Fund Ignored Expert Guidance and Lost Big”

James Neff, Willamette Week August 5, 2025 (link to article )

“Oregon’s pension fund bet big on private equity. That could be a problem”

Ted Sickinger, The Oregonian , July 21, 2025 (link to PDF )

Two recent articles published in The Oregonian and Willamette Week investigate the issue of the Oregon Treasury’s reliance on private investments in Oregon Public Employee Retirement Fund (OPERF). The Treasury’s over-dependence on these funds (often called “private equity”) led Divest Oregon to put forth the Pause Act in the Oregon legislature’s 2025 session.

Although the Pause Act was not enacted into law, it raised questions around the Treasury’s overuse of private investments, that they:

- are heavily invested in the fossil fuel sector

- are secretive - with minimal oversight,

- charge high fees

- are more likely to oppose unionization efforts and are ten times more likely to go bankrupt than their peers not controlled by private equity,

and, as the two recent articles demonstrate, they are not delivering for Oregonians.

As Ted Sickinger explains in The Oregonian :

"For decades, Oregon’s public pension system has been kept afloat by a gusher of income from its investments in private equity, opaque private partnerships that typically buy companies, manage them, then try to sell them at some point for big profits.The returns have played a meaningful role in maintaining the system’s financial health, routinely outpacing other investments and keeping a funding deficit caused by misguided benefit decisions decades ago from becoming even larger than the nearly $30 billion shortfall today.

Yet in the past several years, even as the stock market has been booming, that private equity gusher has slowed to a relative trickle. That’s undermining the system’s total investment returns, causing cash flow issues and, as of July, contributing to another rise in the punishing contribution rates that government employers are required to make to the fund."

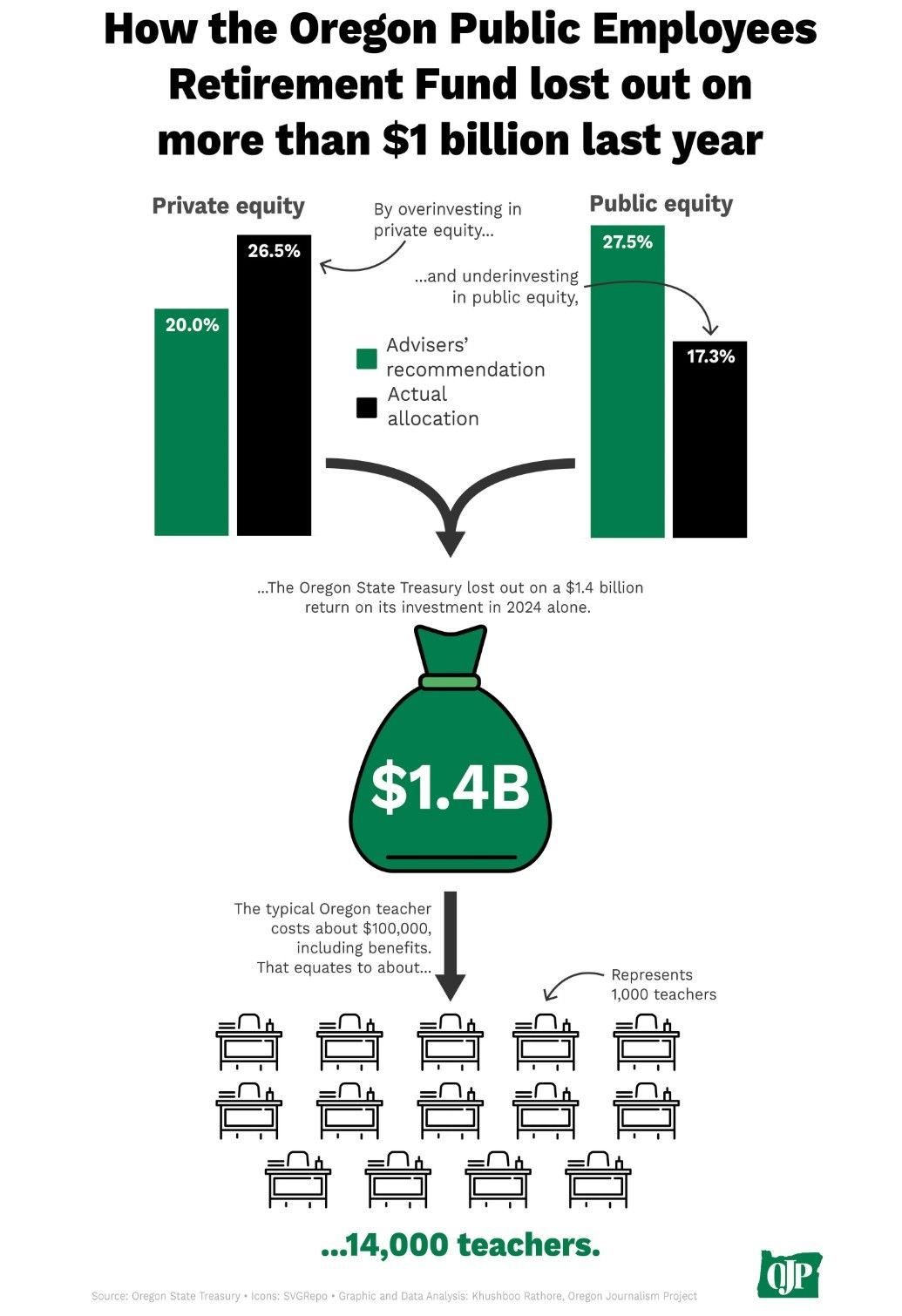

James Neff, in Willamette Week, estimates that OPERF “lost out on” $1.4 billion in 2024 in its rate of return by relying on private investment.

How the Oregon Public Employees Retirement Fund lost out on more than $1 billion last year. (Khushboo Rathore and Whitney McPhie)

These big losses to OPERS are bad for more than 400,000 Oregonians who are PERS members who rely on their retirement now or in the future. But the losses affect everyone in the state. Delving into the “punishing contribution rates” for all government entities that Sickinger cites, Ness highlights the case of the Grant County School District. It had a $900,000 hike in its payment to OPERF this year. That caused the district to make painful cuts and lay off teachers.

Ness says: "Every public employer from the state of Oregon down to the smallest special district – 904 government employers in all – is in materially worse shape this year because of the pension fund’s anemic investment returns."

Further, the article reports:

“An OJP [Oregon Journalism Project] investigation of the Oregon Investment Council, interviews with people in and outside of the State Treasury, and an examination of thousands of pages of documents, meeting minutes and financial data show that those poor returns could have been averted if Oregon had simply invested the funds in accordance with the guidance for which it pays its outside experts handsomely.

For years, that advice has been for the state to put more money in the stock market and less in a form of investment called private equity—a risky kind of financial engineering in which investment managers buy private companies and seek to resell them in seven to 10 years. And while some major state pension funds and university endowments have been reducing their private equity holdings, Oregon has stayed the course."

Results have been dismal.

For the past 10 years, Oregon’s investments in private equity yielded returns below its yardstick—the Russell 3000 Index plus 3%. Last year, Oregon’s private equity portfolio yielded just 4.1%, far below the Russell 3000 benchmark, which yielded 38.4%.”

Private equity might be “embedded” in the culture of the Treasury, but the institution has the capacity for change. We have seen this firsthand: since our coalition’s forming in 2021, the Treasury has emerged as a national leader in climate-safe investing. When it comes to sticky questions around investment allocations -- and bigger ones around how the finance sector is extracting wealth from our communities and our futures -- Treasury staff should demonstrate this same level of leadership.

Listen in to the conversation between James Neff and Dave Miller on OPB’s Think Out Loud (8/11/2025) focusing on the Oregon PERS private investments.

Blog photo credit: Oregon's PERS headquarters in Tigard, photographed in 2018. LC- Mark Graves

Oregon State Treasury should engage or divest from companies fueling a new era of resource conflicts