Oregon Treasury Investment Team Causes $3.7 billion loss to PERS Retirement Fund since 2023.

Treasury staff disregarded policies limiting private equity investments.

Overview

A Divest Oregon analysis of Oregon Treasury private equity investment practices finds that years of exceeding the Oregon Investment Council’s (OIC) policy limiting high-risk private equity significantly reduced the performance of the Oregon Public Employees Retirement Fund (OPERF). These effects total about

$3.7 billion in reduced value since 2023.

At the center of this issue is Oregon Treasury Chief Investment Officer

Rex Kim and his investment team, whose long-term private equity acquisitions significantly exceeded OIC’s risk tolerance for OPERF as stated in its investment policy targets. The

OIC is a trustee, and an agent’s failure to

follow a trustee's instructions is a

breach of trust. These events raise broader questions about policy oversight, internal accountability, and the Treasury’s ability to align its investment practices with new directives under the

Oregon Climate Resilience Investment Act (CRIA).

Policy Departures and Oversight Challenges

Since at least 2019, OPERF’s investments in private equity substantially went over the levels established in OIC’s policy targets. Corresponding reductions in lower-risk public equity went well below target. While the OIC sets investment targets, it relies on Treasury investment staff to implement them faithfully.

By 2022, excessive amounts of private equity led to urgent pressure within OPERF to obtain cash for PERS benefit payments. Treasury then undertook substantial sales of public equities. During this time, the CIO argued (audio at 1:26:40) that OIC’s private equity policy target was just “some 20 per cent artificial number” and existing overinvestments in private equities should continue.

His remark highlights the continuing tension between policy set by the OIC and its implementation by Treasury leadership.

Documented Financial Impact

In 2025, the

Oregon Journalism Project

reported that Treasury’s overinvestment in private equity reduced OPERF’s exposure to better-performing public equities and caused

$1.4 billion in lost value during 2024 alone.

Treasury officials did not contest the reported dollar loss, although

Treasurer Elizabeth Steiner noted that a single-year snapshot cannot fully capture the long-term effects of complex portfolio dynamics. Nonetheless, she

acknowledged in October 2025 the need to rebalance OPERF’s exposure away from private equity toward more liquid, lower-risk assets.

Broader Review by Divest Oregon

Following Oregon Journalism Project reporting,

Divest Oregon conducted an independent

examination of Treasury’s investment return statements from January 2020 through the third quarter of 2025. Impacts were calculated by looking at investment yields as they would have been had the Treasury leadership followed OIC policy targets, and comparing them with the yields that Treasury reported.

The analysis confirmed the substance of the Oregon Journalism Project’s finding of a $1.4 billion underperformance in 2024, and identified additional damage to OPERF returns totaling

$2.3 billion for 2023 and 2025.

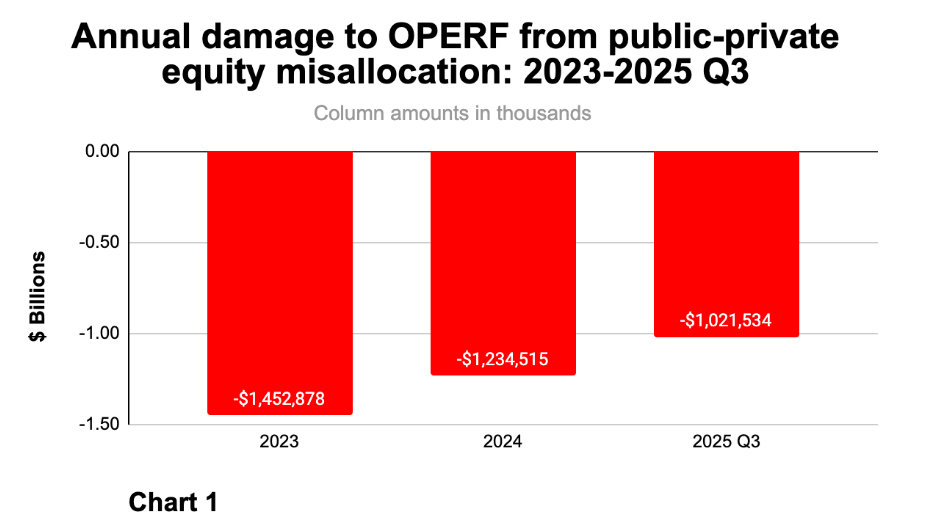

Divest Oregon’s Chart 1 shows these underperformances resulted in cumulative damage of

$3.7 billion to OPERF returns since 2023. Had Treasury met the OIC targets, Divest Oregon calculates that OPERF’s total returns would have increased by

1% to 1.5% annually in 2023 and 2024, improving

the system’s funded ratio in 2024 by roughly

1%, from 73% to 74%.

2022 Valuation Concerns and Market Context

Looking over a longer window—the six years from 2020 to 2025—Divest Oregon found at least $1.6 billion in net damages, reflecting early years of apparent benefit that were later outweighed by much larger declines. These damages are likely to grow to at least $2 billion as losses continue in 2025, with more possible.

An apparent benefit in 2022 stems from private equity’s laggard valuation response to 2022’s market conditions–the first substantial set of interest rate increases in years, followed by a bear market. That year, OPERF reported far better performance in private equity than public equity. At the November 2022 OIC meeting, Treasury’s

Director of Private Markets Michael Langdon acknowledged “an excess mark-up” in the portfolio and warned that future write-downs could erase much of those gains.

OIC audio recording beginning at 58:29.

At the December 2022 meeting, consultant

Meketa

cautioned the OIC that the return difference did not reflect underlying reality. Meketa noted that private equity managers had yet to fully adjust valuations downward during the broader market downturn, and that “a future pullback in these returns is expected.”

Implications for Employer Contributions

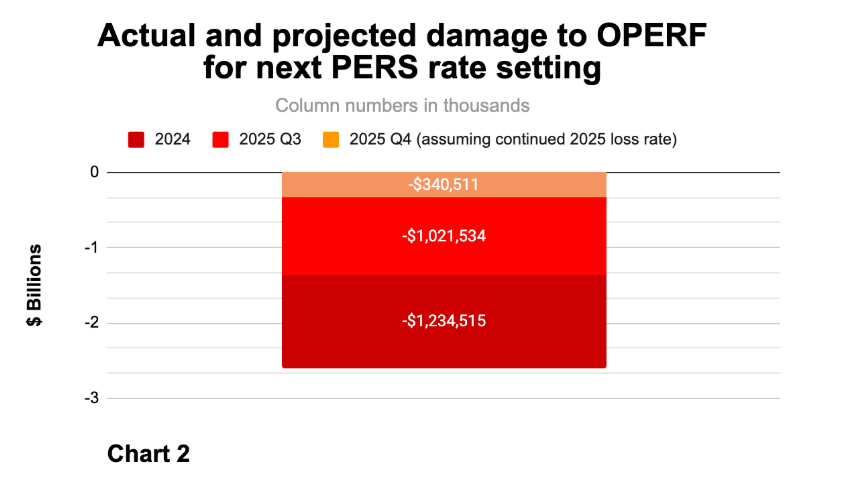

Divest Oregon's Chart

2 shows that the 2024–25 period alone accounted for

$2.3 billion in underperformance, with additional damage of about

$300 million expected if current trends persist through year-end.

2024 and 2025 returns are particularly important because they are considered in setting

PERS employer contribution rates for 2027–2029.

According to PERS, contribution rates ultimately follow a “fundamental cost equation: benefits = contributions + earnings.” If OPERF had met policy-aligned targets, total portfolio returns would have been roughly

7.0 percent rather than the reported 5.7 percent in 2024, and

8.3 percent rather than the reported 7.3 percent in 2025 to date—differences that may affect future employer contribution requirements.

How the Shortfall Developed

Mr. Kim, who had a hedge fund investment background, served on the OIC starting in 2016 and became Treasury’s Chief Investment Officer in April 2020.

By 2018, OPERF’s private equity exposure had already begun crowding out public equity investments set by OIC policy. Mr. Kim continued the practice as CIO–even though when he came on board, OPERF’s private equity returns

had a long history of failing to meet their benchmark, and even of failing to match comparably lagged returns of the Russell 3000, a standard public index fund.

Then a sharp rise in interest rates occurred during 2022,

halving private equity cash flows while increasing capital calls from fund managers, straining OPERF’s liquidity. Because private equity cannot be traded in a direct market, selling in secondary markets is

complicated and costly. Treasury therefore sold

large amounts of public equity assets in order to meet pension obligations. By

December 2023, public equity accounted for only

16.5 percent of OPERF, far below the

27.5 percent policy target—and OPERF missed out on large market gains.

After criticism from Divest Oregon and pressure from Treasurer Read, Treasury began reducing commitments and undertaking about

$4.5 billion in secondary-market sales, as

reported by

The Oregonian. These sales

typically return

68 to 94 percent of book value, but the public does not know the specific amount of any OPERF losses. Treasurer Steiner, despite exemptions in the public records act for financial performance of private investments (ORS 192.355(14)(b))

is

refusing to disclose results of each secondary market transaction.

Pattern of Deviation

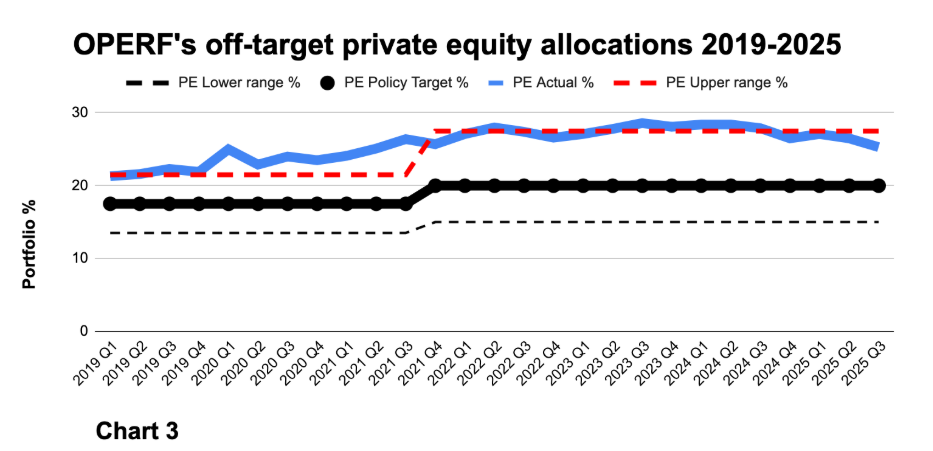

Divest Oregon’s Chart 3 illustrates how the amount of OPERF’s investments in private equity (blue line) has consistently exceeded the OIC’s private equity targets (heavy dotted black line). It also shows the OIC’s upper and lower ranges around those targets (red and black dashed lines).

High and low ranges are not intended to justify consistent overweights in high-risk assets, which can be reduced at no cost by investing in less of them.

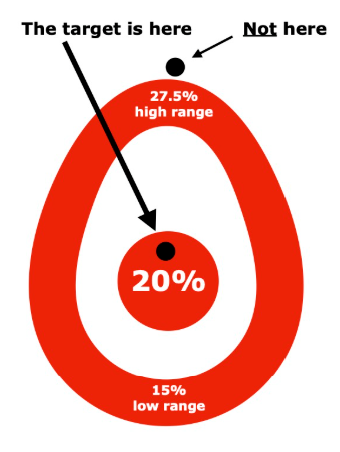

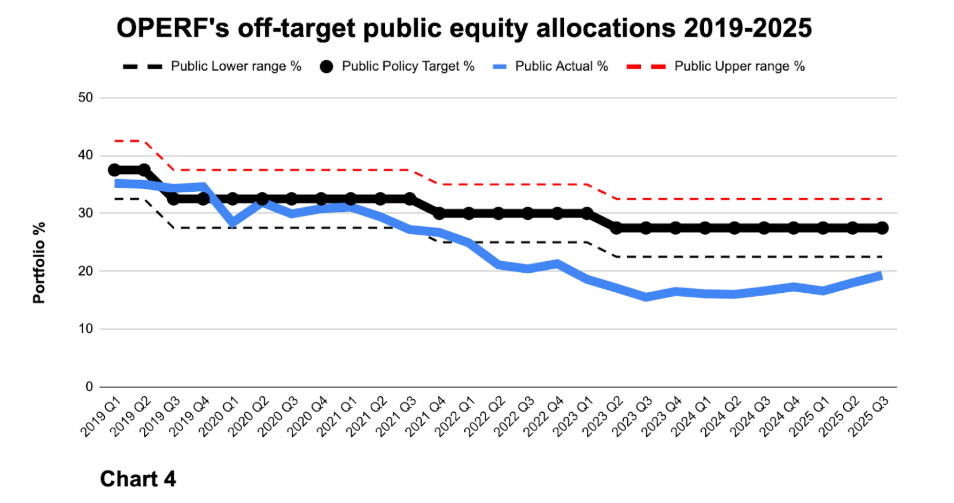

Divest Oregon's Chart 4 shows how OPERF’s investments for public equity consistently were below target, and often well below the lower range, because of the Treasury investment team’s overinvestment in private equity.

Broader Governance Implications

Divest Oregon’s findings highlight the need to ensure that Treasury investment staff faithfully implements policy. Treasurer Steiner now faces practical challenges in restoring alignment between policy and practice. Doing so is crucial not only to protect OPERF, but also to ensure that the Treasury can effectively implement, without direct or indirect avoidance, new climate-aligned, risk reduction investment mandates under CRIA.

Rebuilding Public Trust

Rebuilding public trust requires complete transparency and resulting accountability. Independent analysis by journalists and Divest Oregon has brought long-standing undisclosed issues to light, but the Treasury itself has not yet provided a comprehensive public accounting of the financial impacts to OPERF and what led to them.

A clear, factual, published review of 2019-2025 private and public equity investment decisions—supported by full disclosure of secondary sale results—would help clarify lessons learned, support policy reforms going forward, and begin a process of rebuilding trust.

Conclusion

Oregon Treasury’s extended overexposure to private equity departed from OIC’s intended risk-tolerance policy, contributing to an estimated

$3.7 billion in reduced OPERF performance since 2023. The episode underscores the importance of aligning portfolio strategy with governing policy, maintaining transparency in valuation practices, and ensuring that the OIC, Treasurer, and Treasury staff’s fiduciary duties are exercised with faithful regard for the instructions of policymakers.

Looking ahead, meaningful progress will depend on candid evaluation of past decisions and the establishment of safeguards to prevent disregard of future policy. Only through that process can confidence in Treasury’s stewardship—and in the state’s long-term investment policies under the Climate Resilience Investment Act—be rebuilt.