Press Release: Divest Oregon calls for better screening of investments at Oregon State Treasury

Portland, OR - The Oregon Treasury’s Investment Screening Failures report revisits emblematic fossil fuel projects that the coalition identified as “investment failures” in 2023. These projects worsen the climate crisis, cause harm to communities and the environment, and result in negative economic consequences to state employees’ retirement savings that the Oregon Treasury manages. Treasury is invested in these projects either directly through a private equity fund or indirectly through stock ownership. The report argues that the Treasury must urgently adopt more rigorous screening mechanisms to better protect Oregon’s Public Employee Retirement System (PERS) and help advance a more just energy transition.

“The core question of the report is: Do fund beneficiaries want their retirement money to fund the climate crisis, community destruction and human rights violations?,” said Jenifer Schramm, co-lead of Divest Oregon and the report’s author. “And, are the beneficiaries aware of the financial risk of these investments? Is the Oregon State Treasury aware of the risks?”

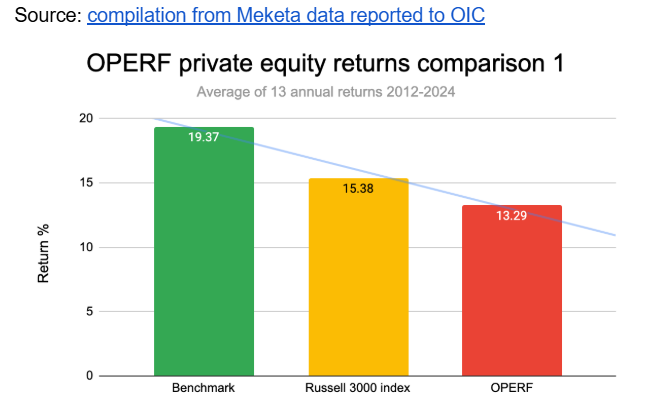

In the fall of 2022, the Treasurer pledged a climate focus in the portfolio. A short while later, the Treasury invested hundreds of millions in a private fund dedicated to construction of a massive liquid natural gas terminal on the Texas Gulf Coast. This financially problematic investment raises the question of the Treasury’s investment selection process. The report argues that better screening, more transparency, and less reliance on notoriously secretive private investments would reduce the harm, increase trust among fund beneficiaries, and ultimately produce better returns.

“The Investment Screening Failures report challenges the Oregon Treasury to tell the beneficiaries of the fund it manages how investments are chosen and what their retirement funds are supporting,” said Richard Brooks, Climate Finance Program Director of Stand.Earth. “The first Failures report graphically illustrated the fossil fuel industry’s disregard for Indigenous rights and labor rights; its destruction of climate and communities. Two years later the profiled investments look no better – and the Treasury continues to invest in the fossil fuel industry. We’ll be watching to see if the Treasury follows the report recommendations and updates its investment screening and oversight.”

Oregon State Treasury should engage or divest from companies fueling a new era of resource conflicts