Press Release: New Oregon law requires State Treasury include ‘just transition’ framework, new report offers roadmap

Portland, OR - Following the recent passage of the Climate Resilience Investment Act ( CRIA - HB2081) requiring that Oregon follow a “just transition” for investments in public markets, a new report from Divest Oregon – Just Transition and the Oregon State Treasury – outlines the urgent need and a framework for the Treasury to support a just transition to clean energy.

According to the Oregon Just Transition Alliance , a nonprofit coalition of rural, coastal, and urban communities, a just transition is “about moving from a harmful, extractive economy to one that gives more than it takes, heals more than it harms, and allows people and the land to thrive.”

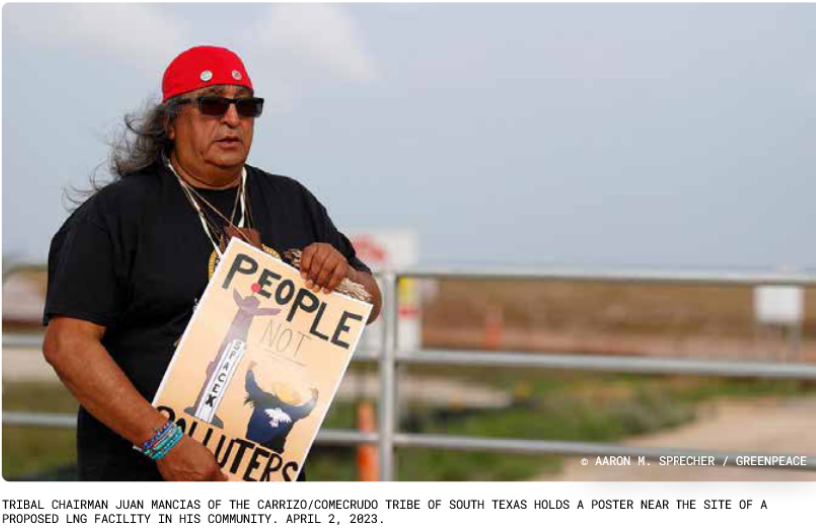

The new report from Divest Oregon highlights key considerations as Oregon invests in a clean-energy future, including how the Oregon State Treasury can advance labor rights and the right to free, prior, and informed consent (FPIC) for Indigenous communities. The report offers a wide range of actions that other pension funds are already implementing to safeguard the long-term sustainability of their investments while providing ways to evaluate similar efforts at the Treasury.

“Advancing a just energy transition is not only a moral obligation to frontline communities impacted by Oregon’s investments, but now a legal requirement that is backed by sound financial guidance,” said Rory Cowal, lead author of the report and Divest Oregon member. “We hope that this new report will offer initial guidance for the Treasury as they create a roadmap to implement their own ‘just transition’ framework.”

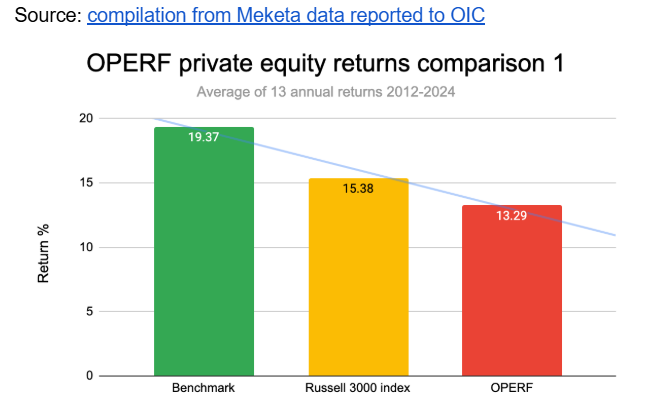

The report outlines the financial benefits to pension funds that promote a just transition toward clean energy, citing the guide for investor action from the Investing in a Just Transition Initiative and United Nations’ Principles for Responsible Investment (UNPRI). Pension funds that utilize these frameworks can more effectively respond to systemic risks, uncover unseen investment opportunities, and contribute to societal goals that enhance the health of the wider portfolio. While the Oregon State Treasury has emerged as an early adopter of this just transition framework, other pension funds have already successfully utilized just transition principles, including the New York State Common Retirement Fund (NYSCRF) and the California Public Employees' Retirement System (CalPERS).

“Oregon Treasury’s commitment to advancing a just transition puts it in line with national and international leaders,” said Susan Palmiter, co-lead of Divest Oregon. “We hope that this report supports Treasury leadership as they take the critical steps to support a clean energy transition in a way that not only complies with the law but allows Oregonians to more fully benefit from climate-safe, rights respecting investments.”

Oregon State Treasury should engage or divest from companies fueling a new era of resource conflicts