Questions for Treasury and OIC about Private Investments

Open Letter to Treasurer Steiner and members of the OIC:

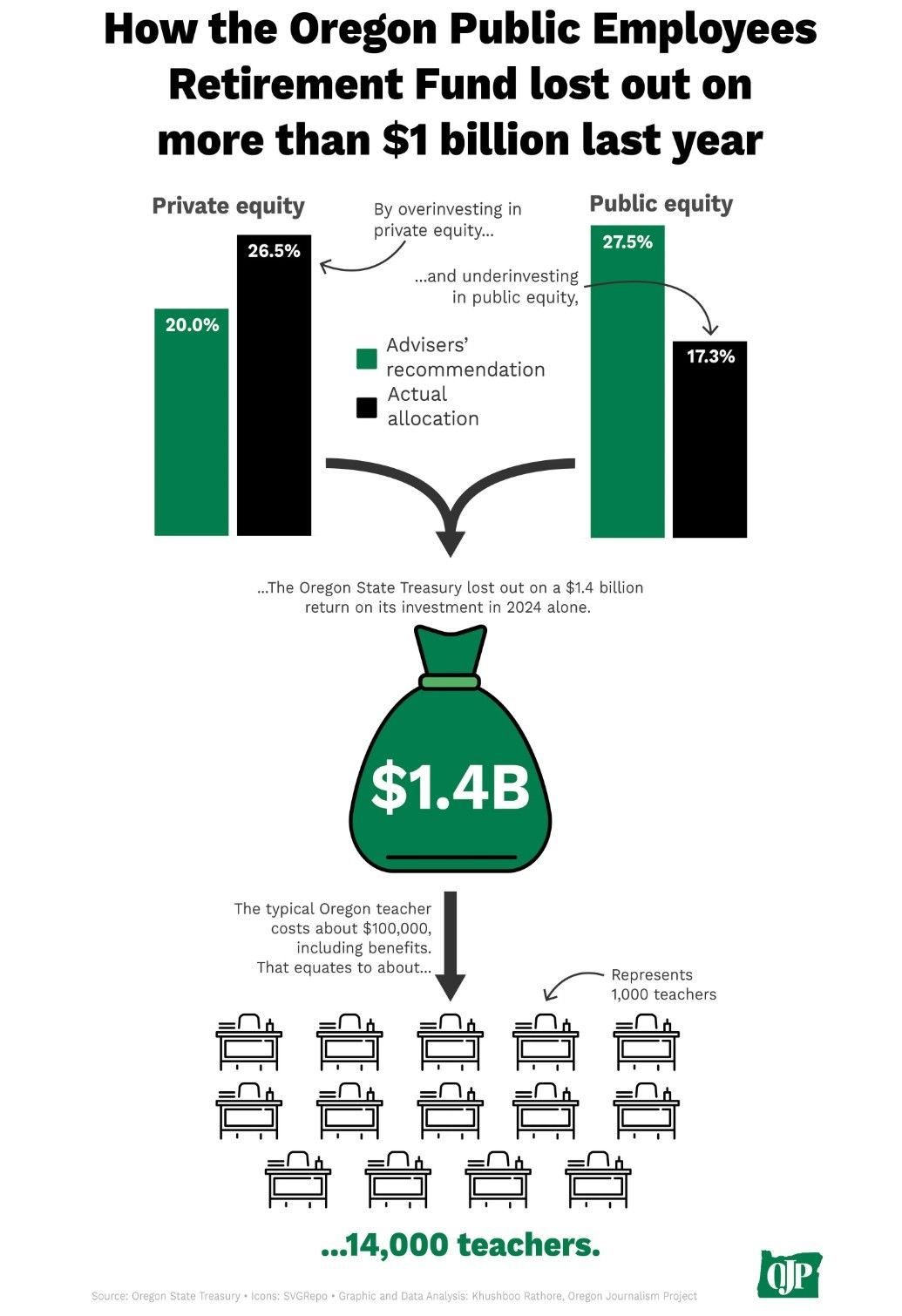

Recent reporting in The Oregonian, Willamette Week and OPB’s Think Out Loud have highlighted concerns about OPERF’s investments in private equity, including acknowledgement by Treasury that OPERF’s 20-year average return for that asset class is 33% below its market outperformance benchmark.

According to those reports, this has resulted in significant investment losses that would not have occurred had OST balanced its portfolio following allocation targets set by the OIC. These losses have subsequently increased the tax burden of public employers, such as schools —schools that have now had to lay off teachers. This has meant that the $500 million increased school funding approved by the legislature in 2025 must be used to pay for increased PERS contributions, rather than being used to improve student outcomes as illustrated below.

On the heels of these reports in the local media, the American Federation of Teachers (AFT), the American Association of University Professors, and Americans for Financial Reform released a report, From Public Pensions to Private Fortunes: How Working People’s Retirements Line Billionaire Pockets (July 30, 2025). The report summarizes in a solid, documented, and readable manner the many studies showing how private equity and related forms of private investment no longer deliver superior returns, particularly on a risk-adjusted basis, along with concerns about workforce management practices.

The response from OST has been less than informative, with simple references to the need to invest “on a 40 year horizon,” which does not answer the critiques from investment experts quoted in the articles or noted in the above articles and report.

It is time for OST leaders to explain to beneficiaries and the public in detail the rationale behind their unusual strategy, including:

● Given the uncertainties of our current economic situation, why do they think private investments will outperform others?

● What data are they using to support this view?

● What guidance are they being given, by whom, to follow this path?

● Given their reference to positive private investment performance in the past, aren't they simply “driving with the rear-view mirror?”

It would appear from recent news reports that OST is taking undue risks with beneficiaries' pensions. It is time for OST to answer the criticisms raised.

For your reference, we have attached a more detailed letter regarding the major issues raised and a list of questions posed by these news articles and reports. We look forward to your response.

Sincerely,

AAUP-Oregon

AFT-Oregon

Senator Jeff Golden

Senator Khanh Pham

Senator James Manning

Representative Farrah Chaichi

Representative Lisa Fragala

Representative Mark Gamba

Divest Oregon Coalition

Attached below: Illustration of losses to Oregon school from the Willamette Week article.

Oregon State Treasury should engage or divest from companies fueling a new era of resource conflicts