Building on Oregon Treasury’s 2025 Progress toward Net Zero Emissions - Part 1

Part 1: Building on Oregon State Treasury’s 2025 Progress toward Net Zero Emissions

Divest Oregon applauds initial action, offers recommendations for future reporting, including the use of multiple metrics

To protect the Oregon Public Employee Retirement Fund (OPERF) from the financial and climate risks of the energy transition, the Oregon State Treasury is one of the few state pension funds with a strategy and commitment to reducing emissions across its portfolio. As part of this commitment, Treasury recently published its “2025 Progress Report: Tracking Net Zero and Climate Positive Investment Strategies.” Divest Oregon, a grassroots coalition representing unions, racial and climate justice groups, youth leaders, and faith communities, has previously applauded Treasury’s progress toward reducing its emissions and welcomes this report.

This progress reflects previous Treasurer Tobias Read’s commitment to Net Zero, the passage of the 2024 COAL Act and the 2025 Climate Resilience Investment Act (CRIA) as well as years of stakeholder, legislative, and coalition engagement (including with Divest Oregon).

Part 1 of Divest Oregon’s review is below. Part 2 can be found here.

In her cover letter and public outreach for the report, Treasurer Steiner has emphasized three major “results of this strategy:”

1. A 50% drop in the “emissions intensity” in OPERF from 2022 to 2023

2. A doubling of “climate-positive” investments as of June 2025

3. A steady decline in fossil fuel private market holdings since January 2023

Divest Oregon has reviewed the report in depth, carefully analyzed these findings (read our full analysis here), and developed specific recommendations for future reporting from the Treasury.

To understand these results, Divest Oregon took a deep dive into the numbers, asking not only “how could this happen” but also “what else can we learn about OPERF’s carbon emissions footprint?”

A 50% Drop in

Emissions Intensity?

Treasury reports a 50% drop in emissions intensity in the OPERF holdings from 2022 to 2023 (the only time period considered in emissions calculations in the report).

A 50% reduction in any emission metric would indeed be remarkable, especially during years when the EPA estimated US emissions dropped by only 4%. How could this happen?

There are multiple ways to measure portfolio emissions in the financial world, depending on what aspect of decarbonization you are interested in.

Pension funds are interested in measuring “transition risk” — the challenge the companies they invest in face in transitioning to a renewable energy future. They measure their holdings’ “emission intensity” to evaluate the size of that “transition risk.”

The emissions intensity metric measures how much carbon a company emits relative to the company’s revenue. In this case, “revenue” refers to the total amount of money a company earns from its operations, such as selling goods or providing services, before any expenses are deducted. The more emissions per revenue, the greater likelihood of a greater “transition risk.”

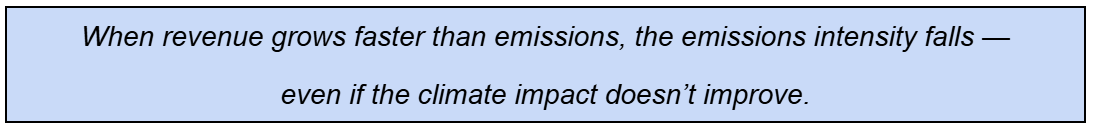

Here’s the catch: Even if emissions increase, the emissions intensity number can still decrease — simply because revenues (the divisor in the calculation) increase even more, which really doesn’t change the transition risk.

That appears to be what happened between 2022 and 2023:

- The emissions associated with OPERF investments actually increased by 28%...

- but because the reported revenue associated with its investments increased by 195%...

- the “emissions intensity” fell 50%

This surge in revenues was driven mainly by one asset class: private equity – and one company within private equity.

The report states that private equity revenues associated with OPERF’s investments went from $242 Billion in 2022 to over $1 Trillion in 2023 – an $780 Billion increase making up 80% of the total revenues associated with its investments. How could

that happen?

Because private equity data is confidential, Treasury relied on modeling rather than company-reported numbers. That makes the results hard to analyze. The report states that private equity’s revenue increased over fourfold from 2022 to 2023 and Treasury shared with Divest Oregon that it attributed this exceptional increase to an indirect stake in a large global technology company with low emissions.

The total 2023 revenues of this global tech company make it a significant market outlier, but there is no way for outside organizations to verify this revenue.

If OPERF’s share of its revenue, as a partial investor, is anywhere near $780 billion, total company revenues would have been multiples of that, into the trillions of dollars. Yet, no company worldwide is reported to have made anywhere near that level of revenue in 2023, or subsequently.

Treasury based much of its 50% improvement in Emissions Intensity on this one outlier.

The Key Net Zero Measure: “Financed Emissions”

Achieving Net Zero for OPERF’s portfolio involves tracking and cutting emissions financed by pension plan dollars until they are balanced out by assets that actively remove carbon from the atmosphere.

Tracking progress to Net Zero depends on tracking the total amount of carbon “owned” by the portfolio’s money. The share of carbon pollution the pension fund itself is responsible for, based on the percentage of the investment it is holding, is called “financed emissions.”

Using this metric:

- OPERF’s total financed emissions rose from 35.8 million to 46 million tons of CO₂e (CO2e is “CO2 equivalents” as defined in the Treasury’s Report)

- That’s a 28% increase… but, again, most of this comes from one asset class: private equity

- According to the Report, nearly half of OPERF’s financed emissions increase came from OPERF’s private equity holdings.

If we exclude the modeled private equity data, a different picture emerges. Outside of private equity, the portfolio’s climate footprint appears largely unchanged. This aligns with broader trends: U.S. emissions changed only modestly over the same period.

Multiple Metrics Tell the Whole Story

Taken together, without the private equity data, these two metrics tell a story of rising revenues during a period when emissions remained about the same. And that is the story of 2022 to 2023, years when the economy was recovering from COVID shocks and energy demand increased.

The reduction in emissions intensity was years before Treasurer Read presented the OST Net Zero Plan and focused staff on strategies to lower the pension fund’s carbon footprint.

No single view of a complex situation is likely to be accurate. Different climate metrics tell different stories and are needed to help tell the full story:

- Emissions Intensity (carbon per revenue) reflects transition risk of the portfolio’s holdings — and is greatly affected by swings in the economy. This is the metric the Treasury used to determine its 50% reduction from 2022 to 2023.

- Financed Emissions (total carbon owned) reflects the portfolio’s progress toward Net Zero. Although not highlighted or discussed, this metric is also reported.

- Financed Emissions Intensity allows internal and external comparisons based on a portfolio’s financial responsibility for emissions.

Relying on the single number of Emissions Intensity — especially one tied to economic swings — can create a misleading snapshot. Experts recommend a dashboard approach using multiple measures.

Better transparency about data quality and assumptions — especially for private equity — would help the public understand true progress.

But, perhaps most importantly, metrics themselves are just numbers. Understanding what is happening behind the numbers, why they go up or down or stay the same, is what makes numbers a meaningful guide to achieving goals. Without context, it is impossible to know what they really mean.

A Doubling of Climate-Positive Investments

To its credit, the Treasury reports that climate-positive investments doubled between 2022 and mid-2025, in line with the Net Zero Plan’s goal of tripling these investments in real assets and private equity by 2035.

These total about $2.4 billion in Real Assets, or roughly 2.4% of the portfolio.

This increase indicates movement in the right direction, though there is room for progress. As with other metrics, context matters: California’s public pension (CalPERS) has committed to investing about 18% of its portfolio in climate solutions by 2030. OPERF should follow suit.

Private Market Fossil Fuel Holdings: Declining — or Just Losing Value?

Treasury reports that private fossil fuel holdings have declined since 2023.

But the report only shows market value. That makes it unclear whether the fund sold or exited fossil fuel assets or if these assets simply lost value.

From this report of annual investments, there is no way to know whether the fund is truly reducing exposure. More transparency is needed.

Building on Progress for Future CRIA Reports

Divest Oregon recommends several practical improvements for the next report mandated by the CRIA legislation and due at the end of 2026.

The Oregon State Treasury should:

Develop a dashboard that includes multiple climate emissions metrics, including financed emissions, and provide data quality scores for the calculated emissions metrics.

Include scope 3 emissions more prominently to fully reflect real portfolio emissions.

Demonstrate more transparency by clarifying private equity assumptions (including estimates or modeling to support inclusion or exclusion of the data), defining what is considered a climate-positive investment, and providing more specificity about fossil fuel investments.

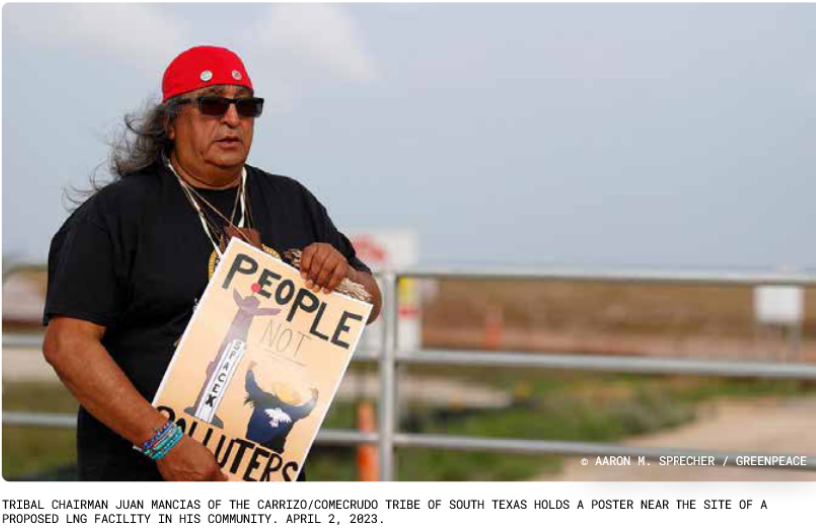

Increase insights and ambition in implementing CRIA by: Explaining how measurement results will guide future decisions including goals and timelines; Demanding transition plans for all private market funds with fossil fuel investments - no matter the amount invested; Stating goals and timelines for emissions reductions; Striving for a higher percentage of climate positive investments; Reporting on progress towards just transition including workers’ rights and Free, Prior, and Informed Consent.

See Part 2 of this blog for a continued analysis of the NZP Report.

Oregon State Treasury should engage or divest from companies fueling a new era of resource conflicts