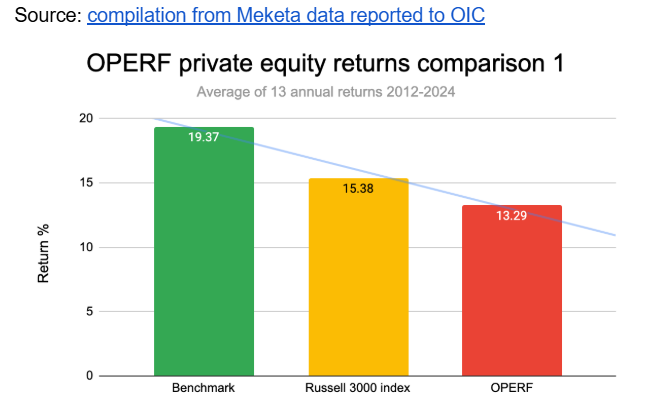

Is OPERF really beating the market? Or is the Treasury just hiding risk?

At the House Committee on Emergency Management, General Government, and Veterans on 2/9/2023, Treasurer Read announced that the Oregon Employee Retirement Fund (OPERF) was the “#1 performing fund in fiscal year 2022” and “over the past 20 years.”

This statement poses a question: How did OPERF suddenly beat the market with such “exceptional results?”

As reported in the industry publication, Pensions and Investments (1), OPERF did better while other state funds had negative returns, not because of doing better in publicly traded equities (stocks), which lost money even for OPERF (-13.3%) -- but because of its relative overweight of high risk “alternative” funds. 60% of OPERF is now held through alternative private contracts, such as investments in private equity, hedge funds, commodities, and real estate / infrastructure, with only around a quarter (2) in lower risk publicly traded equities. This level of high risk private investment is almost twice as high as most other state pension plans (34%%) (3)

Importantly, the value of these private investments and their returns is set, not by the market, but by “expert appraisals that may differ meaningfully from the true market value. (4) ” Because of private contract fee structures and incentives, such appraisals tend to overstate value and respond only slowly to market trends. For the 2022 fiscal year, OPERF showed (5) a 29.6% return on real estate, a 24% return for private equity, and 23% return for other real assets, all values set not by the market, but by asset managers who garner their fees based on returns.

Bottom line: While other state pension plans with larger exposures to public equity showed losses as the market dropped, OPERF continued to report inflated values for its large portfolio of protected private investments, inflating its returns, and suddenly making it appear “the #1 performing fund” for fiscal year 2022.

Does this matter to the legislature? Treasury’s latest PERS By the Numbers report (6) (December 2022) projects that OPERF’s funded status will decrease from 86.4% in 2021 to 79.1% in 2022 with the unfunded actuarial liability increasing from 20% to 26.6%.

As the Equable Institute (7) points out in their report “State of Pensions 2022: National Pension Funding Trends,” state pension plans have not recovered to their pre 2008 recession level of 93.8% funding and face a future of “muted returns.” They emphasize that the system remains “fragile” – faced with inflation and geopolitical instability -- and that the threat of legislatures having to face the politically fraught and contentious process of increasing contributions or cutting benefits can only be mitigated by intense risk management.

PERS beneficiary will be glad to hear when the plan does well – although Treasurer Read did not report that six months later, at the end of the calendar year, OPERF reported a yearly total loss of 1.55%. (8)

PERS members will be more reassured when there is an honest and transparent presentation of the obvious risks the plan faces, supported by data, with specific plans to manage those risks. For me, this is not only financial market risk but also includes climate risk, such as was presented to Treasury in November 2022 by the ORTEC climate risk assessment report they commissioned but seem to have ignored for now over a year.

Support HB 2601 to bring an increased level of transparency, accountability, and risk management to our State Treasury. Glossing over the risks that are increasingly well documented in the pension industry is perhaps the greatest risk of all to the future of PERS, its beneficiaries and contributors. We need legislation to make sure that does not happen.

2 https://www.oregon.gov/treasury/invested-for-oregon/Documents/Invested-for-OR-Performance-and-Holdings/2022/OPERF-12312022.pdf

3 https://crr.bc.edu/wp-content/uploads/2022/11/IB_22-20.pdf

4 https://crr.bc.edu/wp-content/uploads/2022/11/IB_22-20.pdf

5 https://www.pionline.com/pension-funds/oregon-public-employees-pension-fund-returns-63-strength-private-equity

6 https://www.oregon.gov/pers/Documents/General-Information/PERS-by-the-Numbers.pdf

7 https://equable.org/pension-funding-trends-2022/

8 https://www.oregon.gov/treasury/invested-for-oregon/Documents/Invested-for-OR-Performance-and-Holdings/2022/OPERF-12312022.pdf