Oregon lawmakers, grassroots organizations push for evidence-based, financially responsible climate bill to protect state's investments and retirees

Oregon lawmakers, grassroots organizations push for evidence-based, financially responsible climate bill to protect state's investments and retirees.

Salem, OR -- The 2023 Oregon Treasury Investment and Climate Act (HB 2601) addresses the major financial risks posed by climate change and fossil fuel investments, while promoting accountability in the management of Oregon’s investments, said Divest Oregon. State Treasurer Tobias Read has defended the state’s fossil fuel holdings, despite the risks flagged by the Oregon State Treasury’s own consultants and the Treasurer’s release of a long-term decarbonization timeline. The first public hearing for HB 2601 will be held on Thursday, February 16, 2023 in Salem.

State Representatives Pham (HD36), Dexter (HD33), and Gamba (HD41) and State Senator Golden (SD3) are sponsoring HB 2601, which will put a moratorium on new carbon-intensive investments made by the Oregon State Treasury and establish a timeline for the Treasury to drop its carbon-intensive holdings. As part of this decarbonization process, HB 2601 also requires the Treasury to disclose its holdings and show its progress to lawmakers and the public. The Treasury manages $137 billion, with most of this in the Oregon Public Employees Retirement System (PERS).

“This bill is about preparing Oregonians for a financial future shaped by the ongoing transition to clean energy,” said Chris Abbruzzese, an Oregon-based investor and former financial risk manager. “Fossil fuels are currently being phased out globally, yet the Oregon State Treasury continues to invest in these assets, oftentimes through contracts that extend beyond 10 years. By the time climate change becomes a defining issue for financial valuation, it may be too late to eliminate these investments from the PERS portfolio. PERS fiduciaries, like the Treasurer and members of the Oregon Investment Council, serve for four-year terms, a time horizon that is too short given the longer-term issues at hand. As such, we need legislators to act now to limit these actors’ ability to be seduced by short-term returns at the expense of beneficiaries’ longer-term best interests. This bill acknowledges this fiduciary disconnect and protects retirees’ long-term interests as required by Oregon law with an appropriate level of urgency.”

The Oregon State Treasury, which is responsible for the

pensions of 393,080 Oregonians, has at least

$5.3 billion invested in fossil fuel companies. The Treasury is notable for its large interest in private investment funds by contracted managers, including over a

quarter in Treasury's private equity class alone. How those outside managers invest this money is

kept from public disclosure by state law. Many

private equity funds are heavily invested in fossil fuels. As the world transitions to new energy sources, investors left holding stock in fossil fuel companies -- or locked into 10-12 year contracts with private equity firms -- face the

likelihood of these investments becoming riskier, or even worthless, over time.

“Unfortunately, risk to the PERS portfolio because of climate change is not theoretical,”

said

Susan Palmiter, volunteer Co-lead of Divest Oregon.

“We saw how holding on to risky investments for too long results in losses. Following Russia’s invasion of Ukraine, the Oregon State Treasury was left with worthless stock in Russian companies.”

A

February 2022 report prepared by Ortec Finance, contracted by the Oregon State Treasury, demonstrates the "significant negative impacts" of retaining fossil-fuel holdings. The report, which was released to Divest Oregon

after the Treasurer wrote to the Oregon legislature in January 2023, shows that the baseline loss over the next 5 years for not divesting from PERS fossil fuel holdings would be 14.5% in a "disorderly [energy] transition" (the current state of affairs).

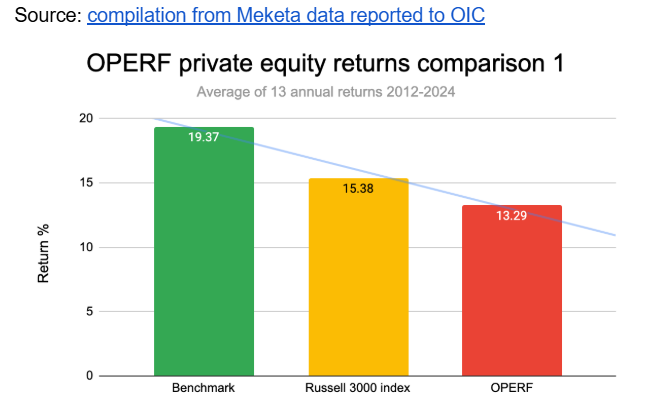

The report also points out that switching out all of the Treasury's public equity holdings in fossil fuel companies would be a positive move in the next 5 years. This corroborates the findings of Divest Oregon’s “Risky Business” report (April 2022) that determined PERS underperformed by $4-10 billion in the past decade due to the drag by fossil fuel investments. In the past decade, this is a loss of up to $6,000 for each PERS retiree per year.

“The Treasurer is treating this time of upheaval as business as usual. He is resisting HB 2601 despite the mounting evidence of long-term decline in the value of fossil fuel investments, his public support for decarbonization of the Treasury investments, the losses that PERS retirees have experienced over the past decade, and the recommendations of his own consultants,” said Jenifer Schramm, volunteer Co-lead of Divest Oregon. “In fact, the Treasury has even made new long-term fossil fuel investments to the tune of half a billion dollars in the month since the bill became public. Rather than obstructing this effort, the Treasury could use this bill to show his support for evidenced-based, financially responsible investing.”

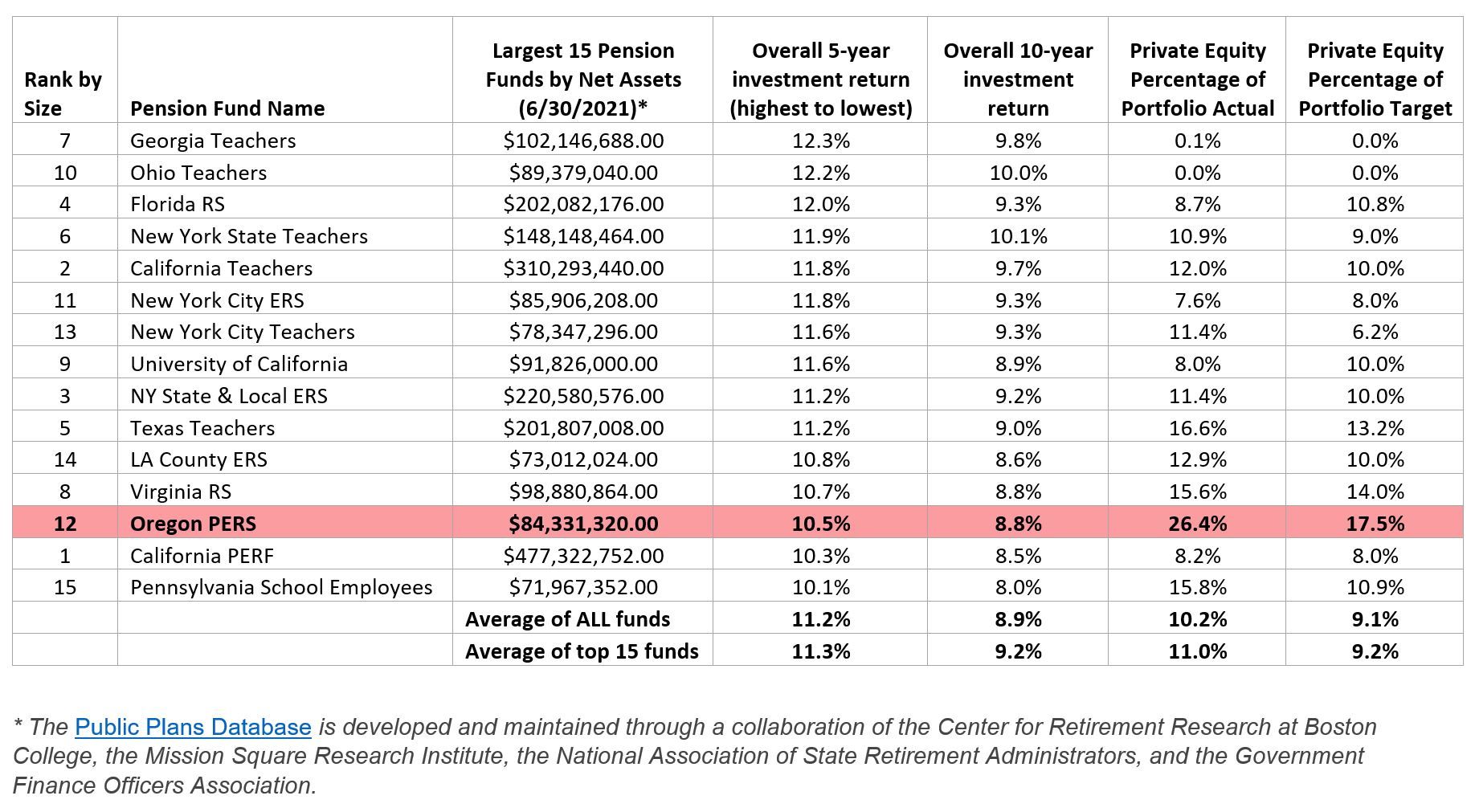

Oregon’s PERS performance lags behind peers, both in terms of real returns and environmental, social, and governance (ESG) standards. Of the top 15 largest US public pension funds, the 5- and 10-year returns for PERS are near the bottom of the pack.

Of these large pension funds, PERS has the highest exposure to private equity investments, which are opaque and difficult to exit quickly. According to the Pew Research Center these types of “risky, high-fee assets … must be scrutinized for transparent reporting.”

“This bill is as much about accountability and transparency, as it is about financial responsibility and climate-smart investing,” said Andrew Bogrand, volunteer Communications Director of Divest Oregon. “Not only does Oregon’s legislature need to mandate an end to new fossil fuel investments and a phased approach to decarbonization, but it must play an oversight role. Discrepancies and public records delays suggest a lack of transparency, as do risky and questionable holdings. HB 2601 will better ensure accountability and help align our state’s investments with our state’s values.”

The Oregon State Treasury has come under national scrutiny for investing in the NSO Group, a spyware company which was blacklisted by the US government after revelations emerged that its signature product was used to spy on dissidents, activists, and diplomats.

According to the United Nations, the Treasury also ranks 46th out of 47th for ESG investing among large public pensions. Poor ESG ratings are linked to poor financial performance. According to

McKinsey, “paying attention to environmental, social, and governance (ESG) concerns does not compromise returns — rather, the opposite.”

“A close look at coal, oil and gas portfolio performance provides overwhelming financial evidence that the industry has declined precipitously and that the outlook for oil and gas companies is negative,” said Tom Sanzillo, past Deputy Comptroller of New York State, and Director of Financial Analysis at IEEFA. “In the past 12 years, the MSCI All-Country World Index (ACWI) without fossil fuels outperformed the MSCI ACWI with fossil fuels. The gap exists even after accounting for the substantial oil price increases that occurred after the invasion of Ukraine.”

To date, over 1,550 institutions representing over $40 trillion in assets have already committed to fossil fuel divestment. HB 2601 is supported by dozens of grassroots organizations across the state, including unions with PERS members, racial and climate justice groups, youth-led movements, and faith communities.

–ENDS–

Notes to editors:

- For more on the 2023 Treasury Investment and Climate Protection Act, see: https://www.divestoregon.org/treasury-investment-and-climate-protection-act.

- For more on the private investments by the Oregon Treasury, see: https://www.divestoregon.org/treasurys-private-investment-problem-report

- Divest Oregon is a statewide grassroots coalition of individuals and 99 organizations representing unions with tens of thousands of PERS members, racial and climate justice groups, youth leaders, and faith communities urging Oregon to divest fossil fuels.

- Divest Oregon is a member of the North America-wide Climate Safe Pensions Network, a network of more than 25 grassroots communities demanding public pension funds divest from fossil fuels and invest in climate-safe solutions.